Services & Fees

Fee-Only Financial Planning and Investment Management Services

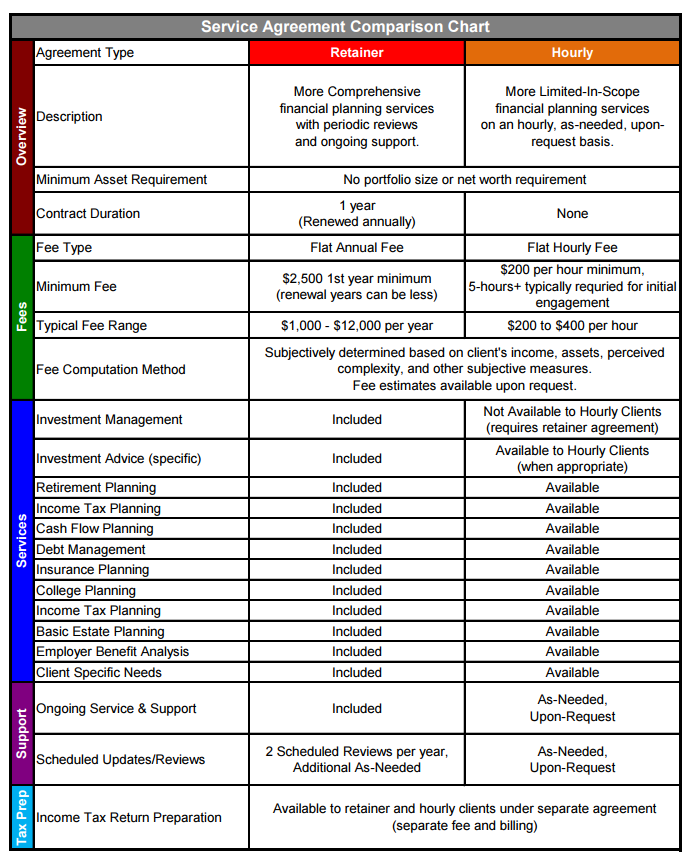

Annual Retainer

We offer comprehensive fee-only fiduciary financial planning and investment management services on an annual retainer basis for a flat retainer fee that includes both financial planning AND investment management. The retainer fee is subjectively determined based on the client’s income, assets, perceived complexity, and other subjective measures. Retainer fee quotes for the first year can be provided after a brief no-cost, no-pressure initial consultation, either over the phone or in-person.

Contact us to learn more or schedule a no-cost, no-pressure initial phone consultation.

Hourly

In some circumstances, more limited-in-scope fiduciary financial advice may be recommended and offered on an hourly basis. The hourly rate is subjectively determined based on perceived complexity and other subjective measures. Hourly fee quotes and estimate of hours required can be provided after a brief initial consultation, either over the phone or in-person.

Contact us to learn more or schedule a no-cost, no-pressure initial phone consultation.

Comprehensive Financial Planning Services:

- Investment advice and planning

- Portfolio analysis

- Risk assessment

- Portfolio diversification optimization

- Investment expense and tax cost optimization

- Specific recommendations for changes

- Investment management

- Trade execution on client’s behalf

- Access to institutional class mutual funds with lower costs

- Access to Dimensional funds

- Retirement planning

- Income and expense estimates

- Goal-based projections

- Social Security optimization

- Income tax optimization

- Income Tax Planning

- Tax return review

- Tax reduction strategies

- Cash flow planning

- Analysis of current cash flow

- Projections of future cash flow

- Debt management

- Debt pay-off strategies

- Mortgage refinance analysis and assistance

- Assistance obtaining competitive financing for large purchases

- Insurance planning

- Home, auto, liability insurance review

- Life, disability, long-term care insurance review

- Specific recommendations for changes to coverage

- Assistance obtaining competitive proposals

- College planning guidance

- Cost projections

- College saving strategies

- Paying for college strategies, student and parent loans

- Income tax optimization

- Basic Estate planning guidance

- Coordination with estate planning attorney

- General review of current documents

- Recommendations for changes

- Estate tax reduction strategies

- Employer benefits analysis

- Insurance benefits

- Pension and retirement savings plans

- Stock options and stock purchase plans

- Client Specific Needs

- Unique financial challenge or decision

AFP Service Agreement Options